We’re introducing a whole host of new features for MIDAS v4.25. One area that’s had a big overhaul for this update is invoicing.

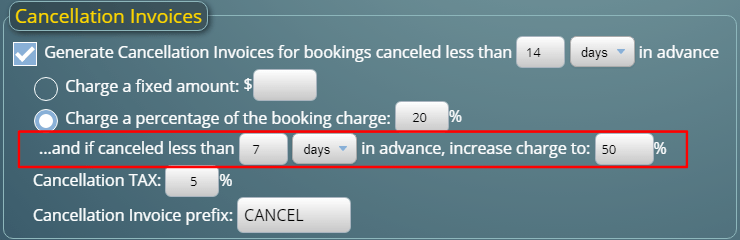

The Cancellation Invoice features of MIDAS automatically generate a charge for clients if their bookings are canceled at short notice.

This charge may be in the form of a fixed amount, or as a percentage of the total cost of their booking.

These appear on an invoice which may be printed or emailed to the client, and which they may pay online.

As mentioned in a previous post, we’re improving Cancellation Invoices for v4.25. Now you’ll be able to set a specific tax rate for all your Cancellation Invoices.

Additionally, we’re adding a new option to automatically increase cancellation charges for bookings cancelled at even shorter notice.

For example, you could configure a 20% cancellation fee if a booking is cancelled less than two weeks before it’s due to take place, and increase this to 50% if cancelled less than one week before.

These are just a few of the new and improved features for MIDAS v4.25. Please see this post for details of other new features you’ll find in v4.25.

![]() You can also ask questions and discuss the new features of v4.25 over on Reddit.

You can also ask questions and discuss the new features of v4.25 over on Reddit.