There’s a whole host of new features in MIDAS v4.25. One area that’s had a big overhaul for this update is invoicing.

In this post we’ll look at some of the improvements in relation to tax handling on invoices.

In earlier versions of our software, you could set a tax rate which would apply to invoice total amounts. At the same time, we provided options to allow you to set individual clients as tax exempt.

We’re providing even more tax flexibility for v4.25, including:

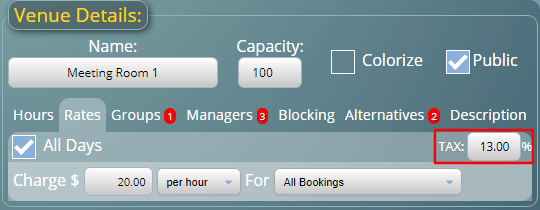

Individual Venue Tax Rates

Each venue can have its own rate of tax applied to it. This allows you to set different tax rates for different venues.

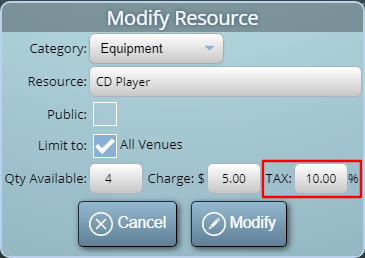

Individual Resource Tax Rates

Each resource item can also have its own rate of tax applied to it. This allows you to set different tax rates for resources.

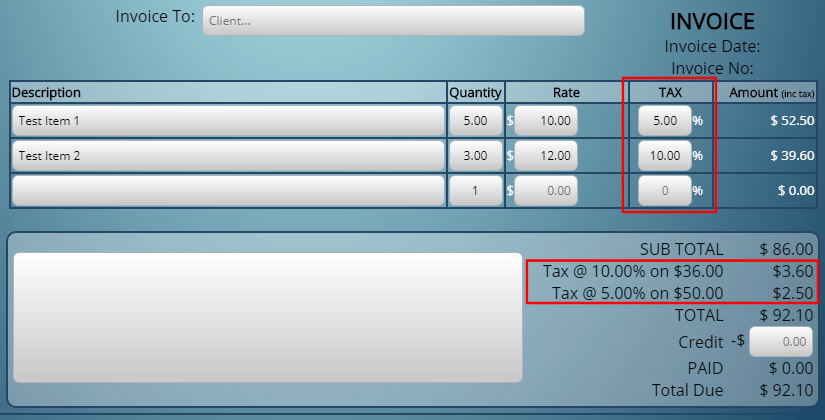

Per-Item Tax Rates

Whereas previously a single rate of tax was applied to an entire invoice, from v4.25, each line on an invoice can have its own tax rate. Each line on an invoice contains the following elements: Item Description, Item Quantity, Item Rate, Tax Rate, and Amount. The invoice summary section will show details of the tax amounts applied to the invoice total.

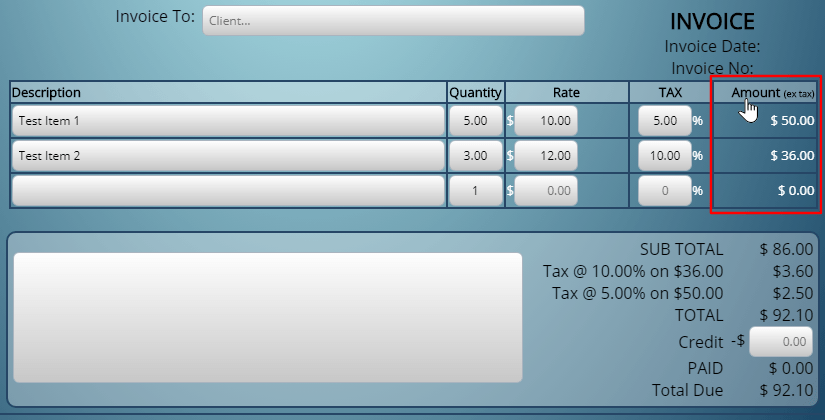

Toggle Amounts Display inc/ex Tax

Calculation of the values shown in the “Amount” is automatic based on quantity, rates, and tax of the line item. When creating or modifying an invoice, clicking on the “Amount” column header will toggle the display of amounts inclusive or exclusive of tax.

We’ve also added a “Show amounts excluding Tax?” admin setting to control the default display of amounts. This setting is located under MIDAS Admin Options → Manage MIDAS → Invoicing.

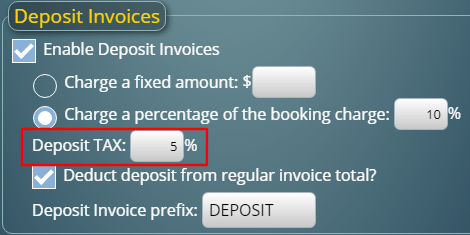

Set Tax Rates for Deposit and Cancellation Invoices

We’ve also added admin settings to allow specific tax rates to be applied to Deposit and Cancellation invoices respectively. Previously, these invoice types applied tax at the global tax rate you’d defined. Now they can each have their own unique rate.

These are just a few of the new and improved features for MIDAS v4.25. Please see this post for details of other new features you’ll find in v4.25.

![]() You can also ask questions and discuss the new features of v4.25 over on Reddit.

You can also ask questions and discuss the new features of v4.25 over on Reddit.