If you’ve been following our recent posts, you’ll know that we’re introducing a whole host of new features for MIDAS v4.25. Many of the new and improved features in v4.25 relate to invoicing.

There’s a lot to take in, so we thought it would be useful to summarize the new and improved invoicing features of MIDAS, with links to posts with more information.

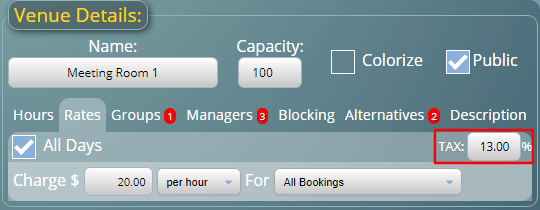

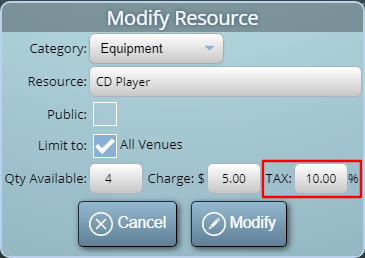

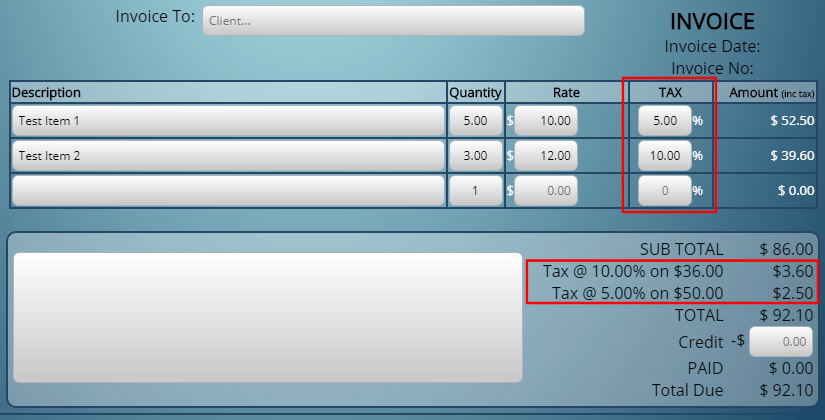

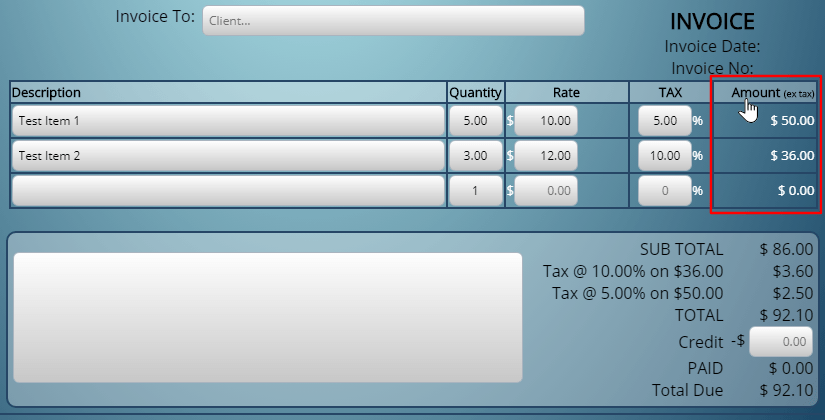

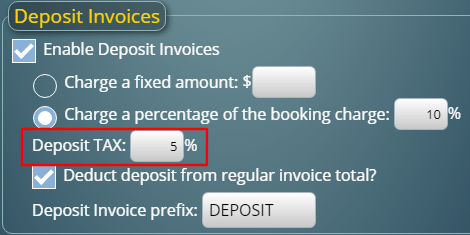

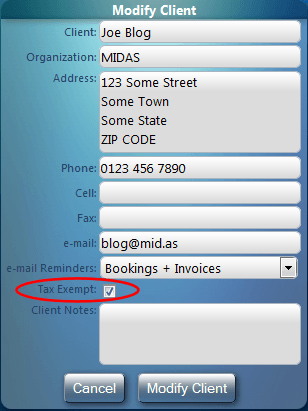

- New Tax Features

- Flexible Payment Terms

- Credit Notes

- Merge Invoices

- Apply Refunds To Invoices

- Export Invoices to 3rd party accounting packages, including QuickBooks, Sage, and Xero

- Increase cancellation charges for very short notice cancellations

In addition to the above, there’s a handful of smaller invoicing improvements worth noting too:

Update visible notes once an invoice has been finalized

Once an invoice is first printed, or emailed to the client, MIDAS considers the invoice “finalized”. The content of finalized invoices cannot then be changed. However, MIDAS does allow you to update the paid status of the invoice at any time. Additionally, you can also add internal notes at any time. Internal notes are not visible to clients on actual invoices.

From v4.25 we’re now also allowing you to modify the “visible” notes section on invoices – even after they’ve been finalized!

Consolidate multiple identical invoice items

MIDAS now consolidates identical items on invoices. For example, say you’re adding a booking across two venues (rooms), each of which requires a “CD Player” resource in it.

When invoicing for these bookings, MIDAS would previously list the two venues separately and the two resources separately.

Now, MIDAS will identify these instances and combine items accordingly. So now instead of having two lines on an invoice both for a “CD Player” and both with a quantity of 1, they’d be a single “CD Player” line with a quantity of 2.

Empty itemized Invoice Notes excluded

The visible “Notes” section on invoices can be configured to be automatically populated with the content of a booking field. For instance, you could set the “Booking Notes” to automatically appear in the “Notes” section of the client’s invoice.

If multiple bookings appear on the same invoice, it could get confusing as to which booking the invoice notes relate to. That’s why we’ve previously provided an “Itemize Notes” option. When enabled, each item on the client’s invoice with an associated note is indicated with a reference number. This appears on the invoice line it relates to, and then also in the Notes section below.

If an item had no notes associated with it however, it would still be given a reference number. This could be just as confusing if none of the bookings had notes. You’d end up with a string of meaningless numbers in the Notes section, like [1] [2] [3] [4] [5]

We’ve sorted this out for v4.25! Now, only bookings with notes will be numerically referenced if the “Itemize Notes” option is enabled.

These are just a few of the new and improved features for MIDAS v4.25. Please see this post for details of other new features you’ll find in v4.25.

![]() You can also ask questions and discuss the new features of v4.25 over on Reddit.

You can also ask questions and discuss the new features of v4.25 over on Reddit.